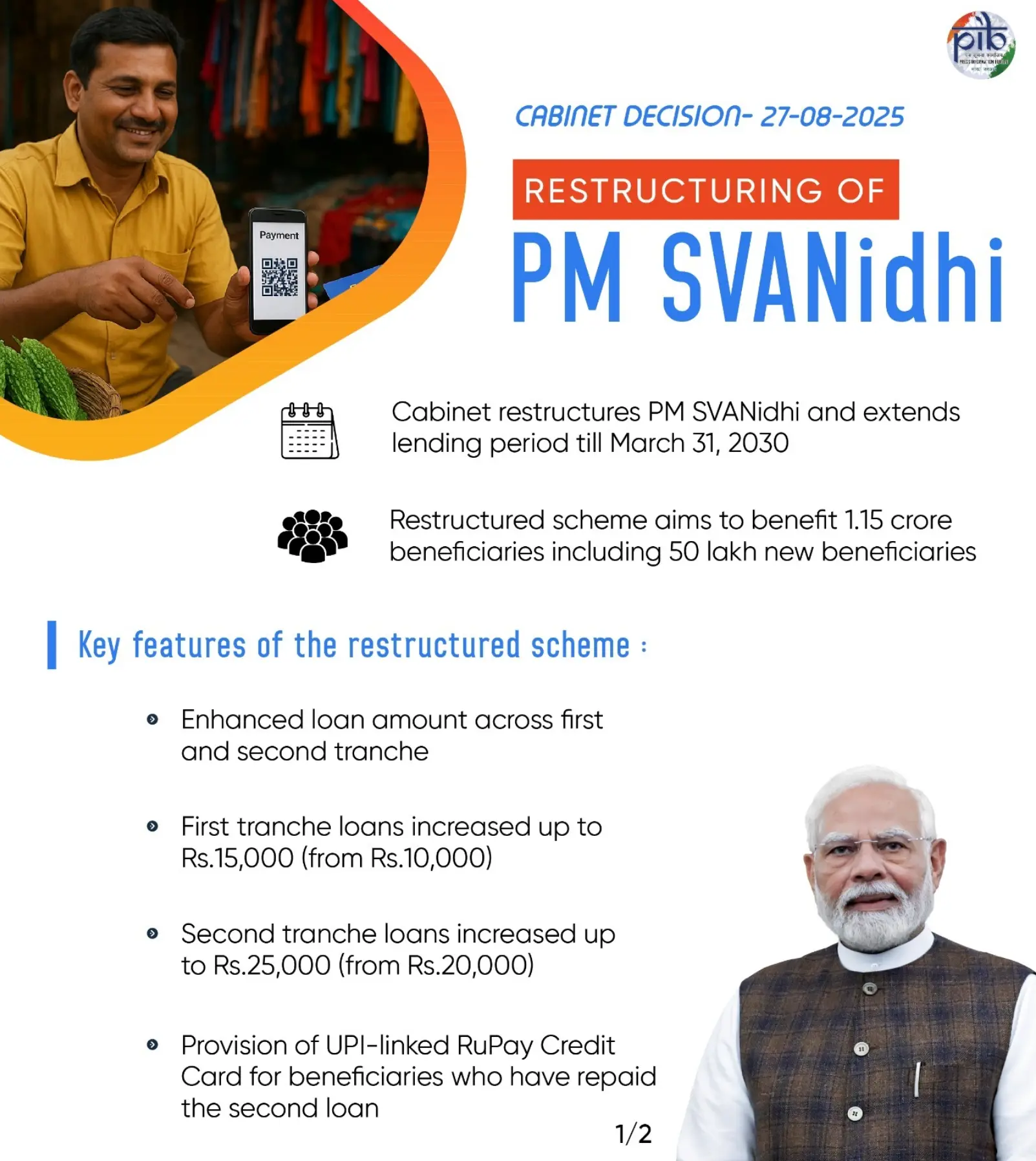

Government of India has approved the launch of PM SVANidhi 2.0, a major upgrade to the flagship PM Street Vendor’s AtmaNirbhar Nidhi (PM SVANidhi) scheme that was first introduced during the COVID-19 pandemic. Under the PM SVANidhi 2.0 Scheme, the central government will provide bigger loans, 7% interest subsidy, and new digital empowerment tools, directly benefiting lakhs of urban street vendors, hawkers, and small informal business owners across the country.

The scheme has now been extended to 31 March 2030.

As per the new updates, PM SVANidhi 2.0 will offer loans up to ₹50,000, a 7% interest subsidy, and new RuPay credit cards with a credit limit of ₹30,000, taking the empowerment of street vendors to the next level.

PM SVANidhi Scheme: Background and Need

India’s urban street vendors, commonly known as thelewala, rehriwala, hawkers, and phadwala, are the backbone of the urban informal economy. They provide essential goods and services like vegetables, fruits, ready-to-eat food, tea, snacks, apparel, shoes, repair services, books, laundry, and much more at the doorstep of city dwellers, usually at very affordable rates.

Also Read: PM Vishwakarma Loan Scheme

During the COVID-19 lockdown, these micro-entrepreneurs suffered a huge blow as their small capital was exhausted, and businesses came to a standstill. Recognizing the need to provide working capital support, the government launched the PM SVANidhi Scheme in 2020.

Key Features of PM SVANidhi (Original Scheme)

- Central Sector Scheme: Fully funded by the Ministry of Housing and Urban Affairs (MoHUA).

- Working Capital Loan: Up to ₹10,000 for eligible urban street vendors, with no collateral required.

- Incremental Loans: After successful repayment, the vendor could get ₹20,000 and then ₹50,000 in the next cycles.

- 7% Interest Subsidy: Directly credited to the vendor’s bank account quarterly.

- Digital Payments Incentive: Cashbacks of up to ₹1,200/year for adopting digital transactions.

- Eligibility: Vendors in notified states/UTs as per the Street Vendors (Protection of Livelihood and Regulation of Street Vending) Act, 2014, or the equivalent state act.

- Identification: Through Certificate of Vending/ID Card issued by Urban Local Bodies (ULBs), or Letter of Recommendation (LoR) from ULBs/Town Vending Committees (TVC).

- No Prepayment Penalty: Vendors can repay early without extra charges.

- Loan Tenure: 1 year, repaid in monthly installments.

Eligibility Criteria for Beneficiaries

- All street vendors engaged in vending in urban areas as on or before March 24, 2020.

- Must possess following documents / eligibility:

- Certificate of Vending/ID Card issued by ULBs,

- Or, included in ULB survey but not yet issued a certificate,

- Or, having a Letter of Recommendation from ULB/TVC (for those left out or starting vending after the survey),

- Or, vendors from peri-urban/rural areas vending within ULB limits (with LoR).

Special Provisions

- Vendors who migrated back to villages during COVID-19 can apply when they return.

- ULBs have to verify and issue LoRs within 15 days of application.

Achievements of PM SVANidhi (Till July 2025)

Over 96,09,092 street vendors have received loans totaling ₹13,794 crore as of 11 July 2025.

PM SVANidhi 2.0: What’s New and What’s Changing?

Highlights of Differences

| Feature | Old Scheme | PM SVANidhi 2.0 (Proposed) |

|---|---|---|

| Maximum Loan Amount | ₹10,000 → ₹20,000 → ₹50,000 (staggered, on repayment) | ₹50,000 upfront for eligible vendors |

| Interest Subsidy | 7% | 7% (Continued) |

| Digital Cashback | Up to ₹1,200/year | Likely to continue, plus added digital benefits |

| Digital Credit Access | Not provided | UPI-linked RuPay Credit Card with ₹30,000 limit |

| Implementation Timeline | Until March 2022 (original subsidy deadline), further extended | Proposed to continue till FY2030-31 (16th Finance Commission period) |

| Target | Vendors in notified states/UTs under SV Act, 2014 | All current eligible plus new digital users |

| Budget | Initial outlay | Over ₹500 crore for 2.0 phase |

| Last Date | 31 December 2024 | 31 March 2030 |

Interest Subsidy and Cashback

- Vendors who borrow under the scheme will continue to get 7% interest subsidy, paid directly into their accounts, just as in the original scheme.

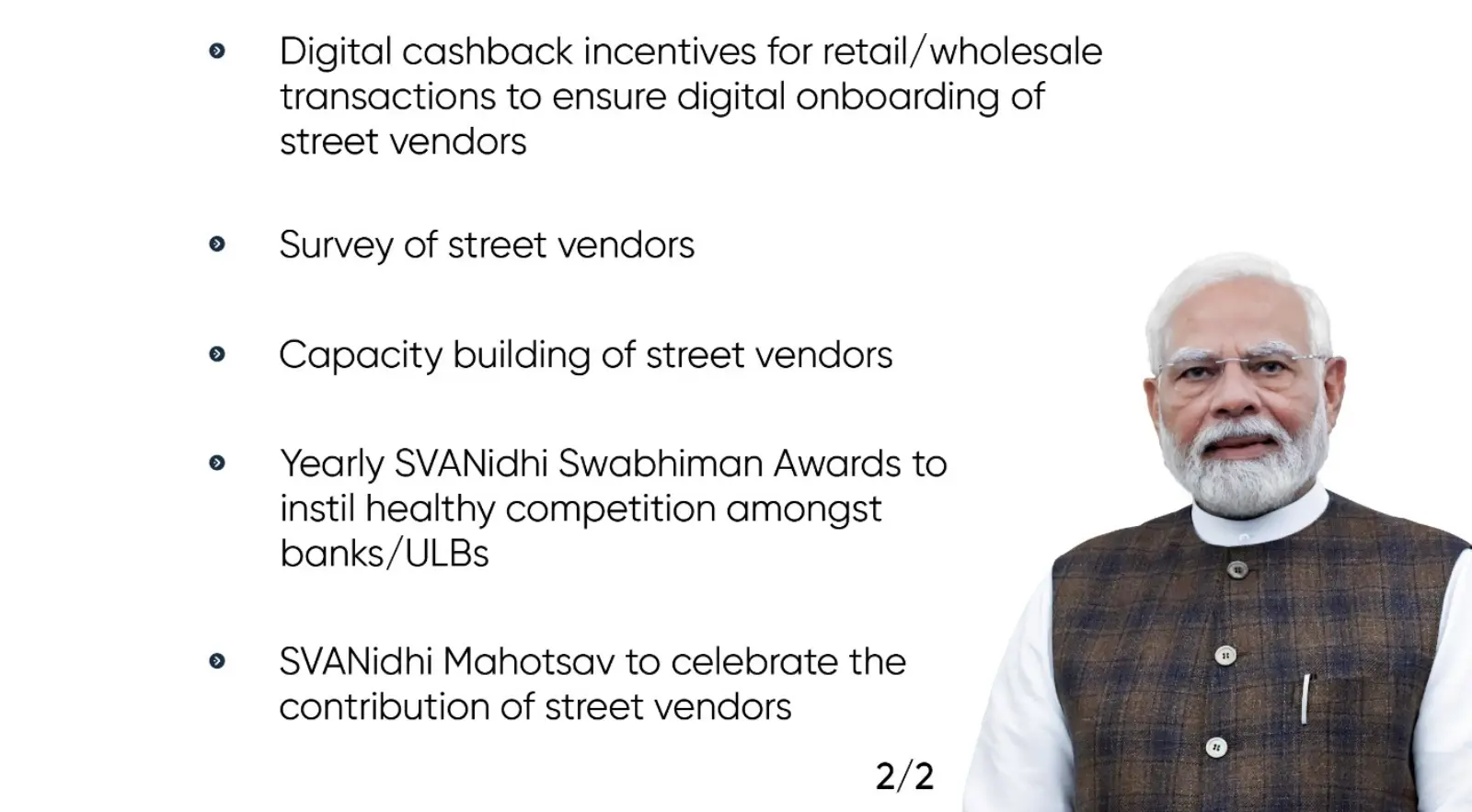

- Digital payments will be further encouraged, likely through enhanced incentives or cashbacks.

New RuPay Credit Card

- Vendors will receive a UPI-linked RuPay credit card with a ₹30,000 limit.

- Enables cashless transactions, purchases, and builds a digital credit history.

Bigger, Simpler Loans

- Up to ₹50,000 can be accessed by eligible vendors directly, rather than in staggered steps.

- Loans are collateral-free.

- Repayment is to be made in monthly installments.

Digital Empowerment

- The scheme will integrate UPI, digital payments, and the RuPay credit card to make credit access and repayments smoother.

- The entire process is likely to be online through the PM SVANidhi web portal and app.

Objectives and Benefits of PM SVANidhi 2.0

- Boost Working Capital: Larger, collateral-free loans help vendors increase inventory, expand business, and recover from financial stress.

- Encourage Regular Repayment: Timely payment incentives create a healthy credit culture among informal sector workers.

- Promote Digital Inclusion: With UPI, RuPay cards, and digital cashback, vendors can accept payments, access credit, and maintain a digital trail, helping them qualify for future loans.

- Formalization of Informal Economy: The scheme brings street vendors into the formal financial ecosystem, making them visible for future government support and welfare schemes.

- Support Women Entrepreneurs: Many street vendors are women; the scheme helps them access finance and grow independently.

Eligibility Criteria for PM SVANidhi 2.0

- Street vendors (including thelewala, rehriwala, hawkers, etc.) operating in urban/peri-urban areas of India.

- Those registered with their ULBs or holding valid vending certificates/IDs.

- Vendors recognized via survey, or with LoR from the ULB/TVC.

- Vendors from rural areas vending in city limits (with LoR).

- Migrant vendors returning after COVID-19.

Note: Final guidelines for PM SVANidhi 2.0 may further relax or update these criteria to include new digital entrepreneurs.

How to Apply Online for PM SVANidhi 2.0?

Though official guidelines for 2.0 are awaited, the process is expected to be similar to the existing scheme:

- Register/Verify: Vendor checks eligibility and verifies status (with ULB or online via the official portal).

- Prepare Documents: Certificate of Vending/ID, or LoR from ULB/TVC, Aadhaar, bank account details, and mobile number.

- Apply Online: Application through the official PM SVANidhi portal/app or via the nearest participating bank, BC, NBFC, or MFI.

- Get Verification: ULB/TVC verifies the application and documents.

- Loan Disbursal: After approval, the loan is disbursed directly to the vendor’s bank account.

- Get RuPay Card: Eligible vendors may get the RuPay credit card linked to their loan account.

- Start Repayment: Monthly EMI begins; regular repayments enable access to higher loan limits and additional incentives.

Note: For 2.0, the integration with UPI and RuPay card issuance is expected to be smoother and more digital-first.

PM SVANidhi 2.0 is more than just a micro-credit scheme; it is a policy shift towards building a resilient, self-reliant, and digitally empowered informal sector in India. By providing bigger loans, digital credit access, and continued support for regular repayments, the scheme ensures that street vendors are not just surviving but thriving and scaling their businesses.

FAQs

What is PM SVANidhi 2.0?

PM SVANidhi 2.0 is the upgraded version of the government’s micro-credit scheme for street vendors, offering bigger loans (up to ₹50,000), a 7% interest subsidy, and a digital RuPay credit card with ₹30,000 limit.

Who can get loans under PM SVANidhi 2.0?

Any registered street vendor in an urban or peri-urban area, with a Certificate of Vending, ID Card, or Letter of Recommendation from the ULB/TVC.

How is the loan repaid?

Loans are repaid in monthly EMIs over one year, with the option to prepay without penalty.

What is the 7% interest subsidy?

Vendors get a 7% interest subsidy credited to their account quarterly, reducing the overall interest burden.

Will digital payments incentives continue?

Yes, vendors using digital payments will continue to get cashbacks and may also get RuPay credit cards for cashless business.

How to apply for PM SVANidhi 2.0?

Vendors can apply online through the official PM SVANidhi portal, via the mobile app, or through banks, BCs, NBFCs, and MFIs.

Is the PM SVANidhi 2.0 scheme only for existing vendors?

No, new vendors identified by ULBs/TVCs or those with proper documentation may also become eligible.