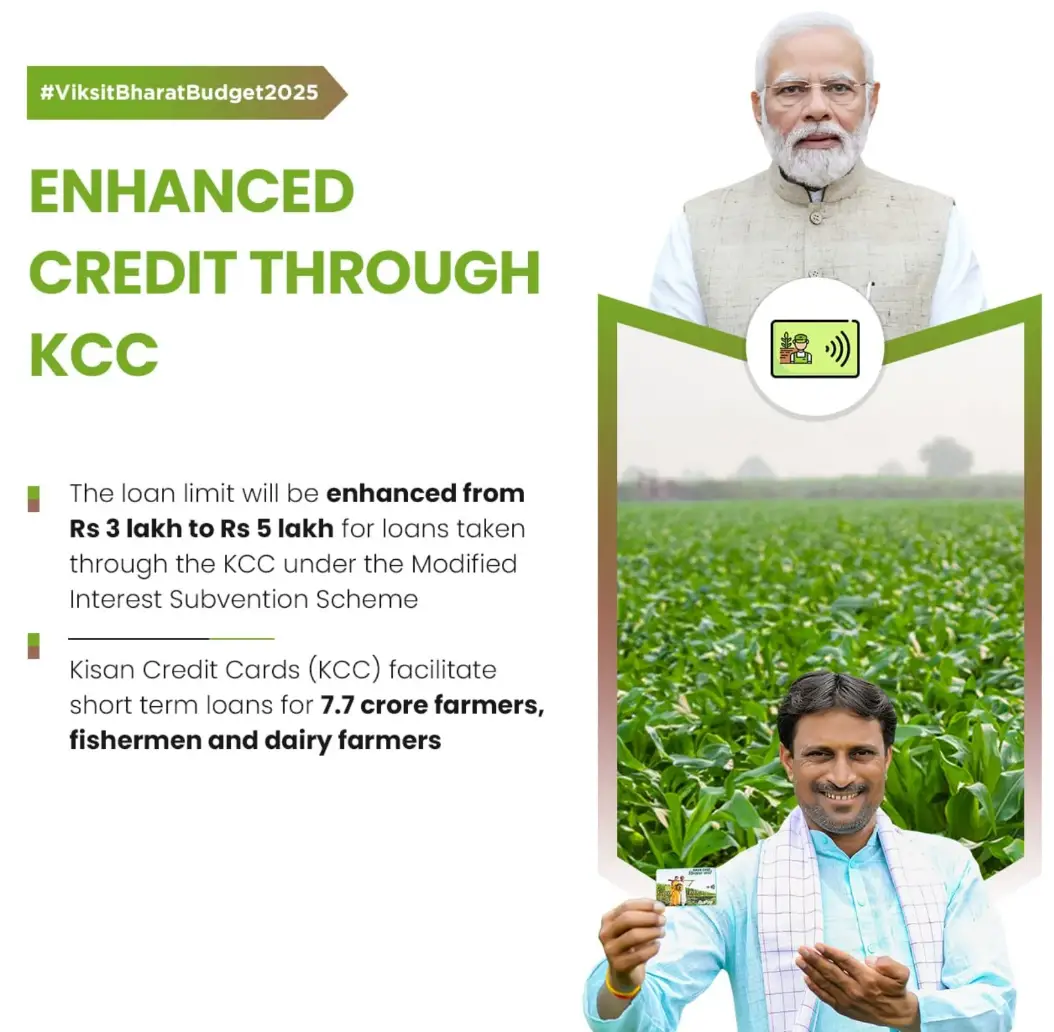

Kisan Credit Card (KCC) Scheme 2025 brings a significant boost to India’s agricultural sector by increasing the loan limit from ₹3 lakh to ₹5 lakh. This major update is set to benefit millions of farmers across the country, enabling them to invest in modern farming methods, better equipment, and sustainable practices. Finance Minister of India, announced the limit increase while presenting 2025-2026 union budget.

What is the Kisan Credit Card (KCC) Scheme?

Kisan Credit Card Scheme was introduced to provide farmers with access to timely and affordable credit for their agricultural needs. The scheme offers short-term loans at subsidized interest rates, helping farmers meet expenses related to crop production, equipment purchases, and other farming activities.

Kisan Credit Card Interest Rates

Under the Kisan Credit Card Scheme, farmers can access highly affordable credit at just 4% annual interest, thanks to the Government of India’s support through a 2% interest subsidy and an additional 3% discount for timely repayment.

Major Updates to KCC Scheme 2025

- Higher Credit Availability: Farmers can now access loans up to ₹5 lakh, up from the previous limit of ₹3 lakh, enabling greater investment in agricultural modernization and infrastructure development.

- No Security Requirement: For loans up to ₹2 lakh, farmers aren’t required to provide collateral, making credit more accessible and streamlining the borrowing process, particularly for smaller agricultural holdings.

- Broad Coverage: The program welcomes diverse agricultural participants including those who lease land, own their farms, work on crop-sharing arrangements, or belong to group farming initiatives. The scheme also extends benefits to those in allied sectors like animal husbandry and fisheries.

How to Apply for Kisan Credit Card 2025 (KCC) – Step by Step Guide

The Kisan Credit Card (KCC) application process is simple and can be completed online or offline through various banks.

1. Check Eligibility

- Who can apply?: Farmers, owner-cultivators, sharecroppers, tenant farmers, and those in allied activities (dairy, fisheries) can apply for Kisan Credit Card Scheme 2025.

- Age Requirement: 18-75 years (above 60 years may need a co-borrower).

2. List of Required Documents for KCC Application

- Identity Proof (Aadhaar, Voter ID, etc.)

- Address Proof (Aadhaar, Utility Bill)

- Land Ownership or Lease Proof

- Passport-sized photos

3. Choose a Bank

You can apply through any bank offering KCC. Here are some of the major public service banks offering KCC applications through offline and online modes.

4. Application Process

Online Method:

- Visit the KCC online application link of the bank website as given in the above table, fill out the online application form, and upload documents.

- Submit the form and save the reference number.

Offline Method:

- Visit the nearest bank branch, collect the form, fill it out, and attach the necessary documents.

- Submit the form to the bank official.

5. Verification & Approval

- The bank will verify documents and, if needed, conduct a field inspection.

- Upon approval, the credit limit will be sanctioned.

6. Receive the Kisan Credit Card

- The bank will issue the KCC, which you can use for agricultural expenses like seeds, fertilizers, and equipment.

By following these steps, farmers can access affordable credit under the KCC scheme and meet their financial needs easily.

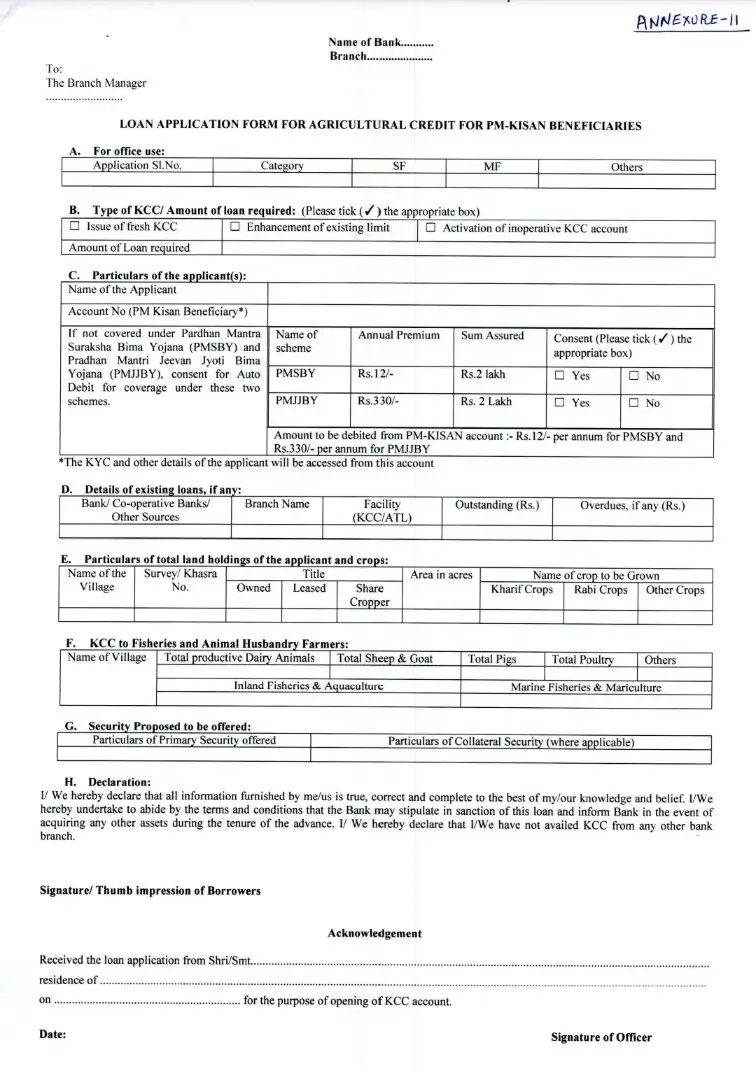

Download KCC Application Form 2025 PDF

If you want to apply online for KCC through offline mode, you can download the application form from the official website of PM Kisan or using this direct link.

Kisan Credit Card Application Form

Kisan Credit Card Scheme 2025 is a step forward in the government’s efforts to empower farmers with financial stability and modern agricultural resources. With the increased loan limit and additional initiatives, farmers can boost their productivity, reduce their financial burden, and contribute to the nation’s agricultural growth. The scheme’s comprehensive approach promises to improve rural livelihoods and promote sustainable agricultural practices.